CUSTOMER CASE STUDY

Client is a leader producer of electronic microscopy and scanning equipment. After multiple expansion into new products and new markets, the company was purchased by Private Equity, moving the company from a closely held family business to a multinational structure.

Results

Story

Successful organic growth including new product introductions, acquisitions and tripling its distributor network across new markets left the operations and supply chain without the required structure for its next stage of development under Private Equity ownership. Long lead times, customer service inconsistency, rising quality issues and lack of transparency became top priorities for building a new foundation to maintain its continued high growth trajectory.

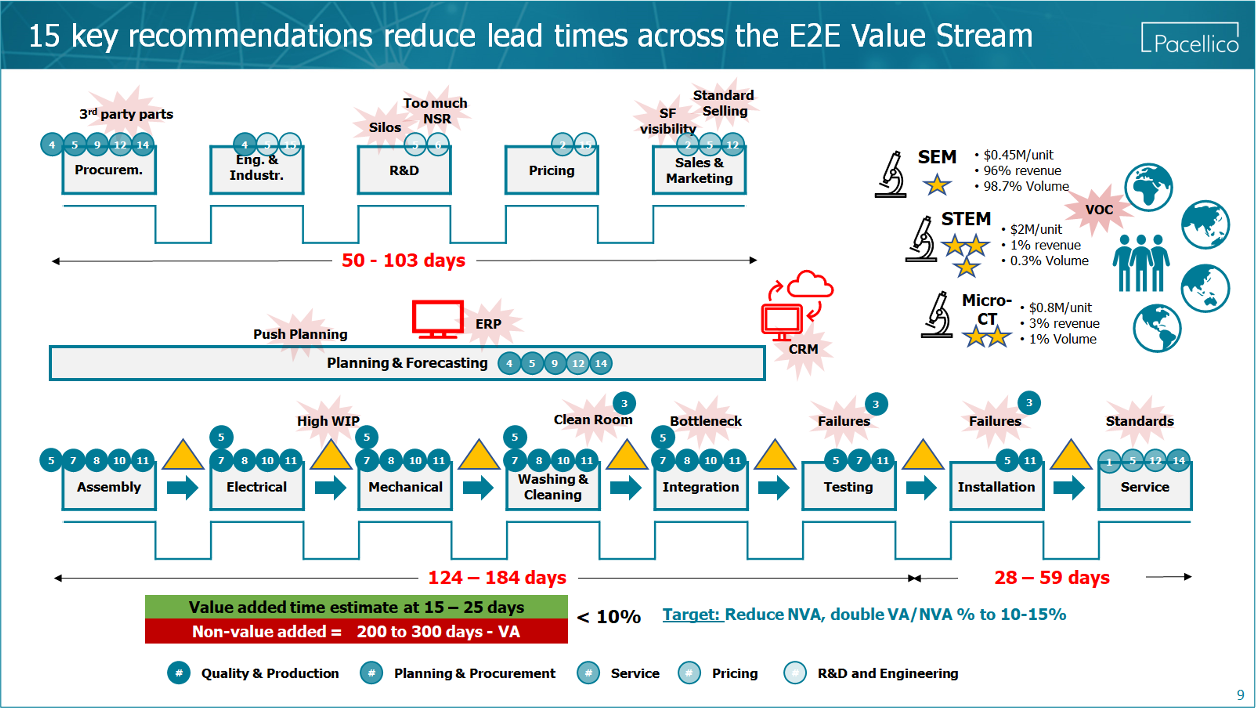

Using a combination trainings, workshops, interviews and data analysis we focused the following key opportunities:

- Training the executive team

- Value stream mapping quantify the opportunity

- Mig data analytics across the end-to-end supply chain

Conclusion

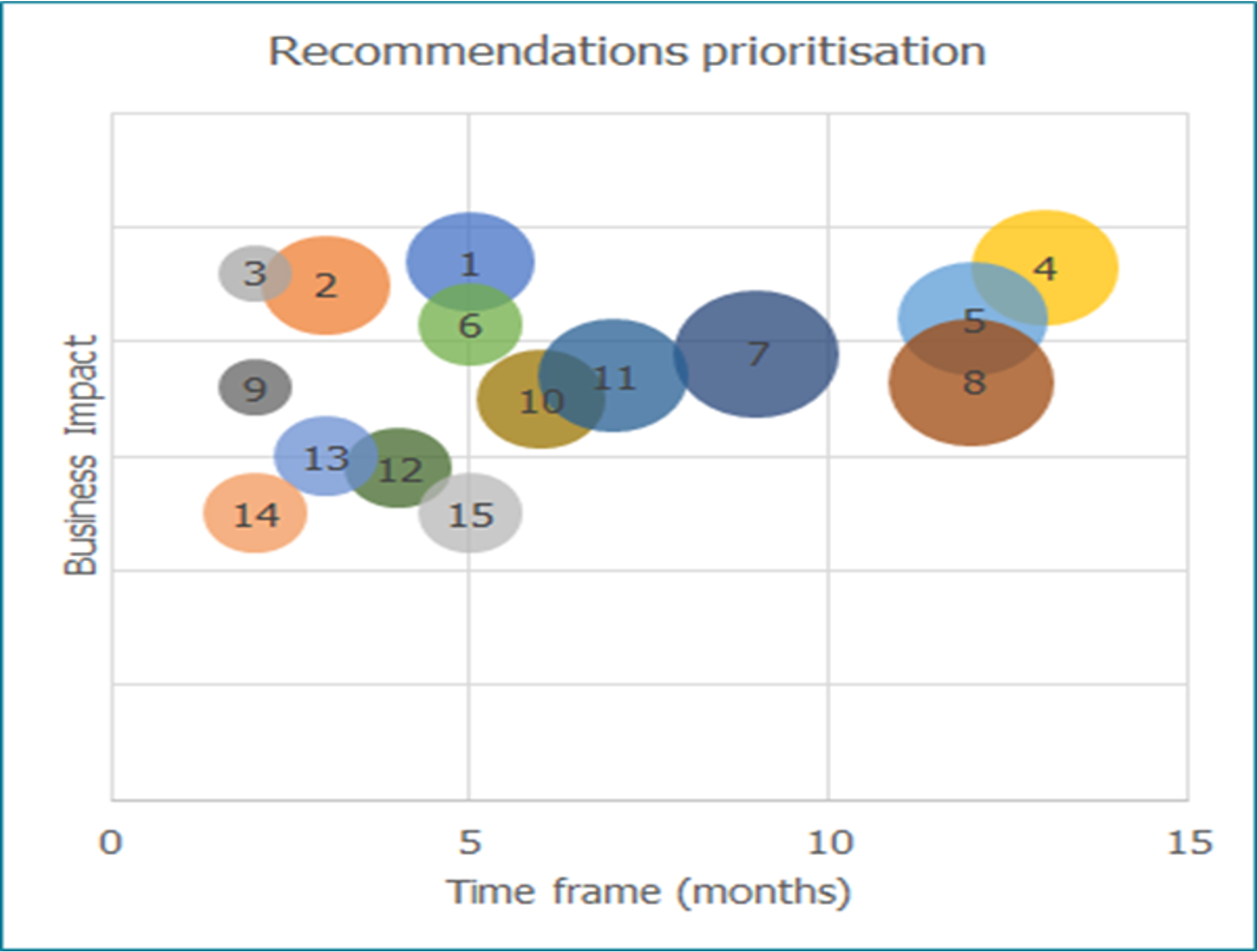

Together with management team we facilitated a prioritize set of improvement initiatives valued at €15 to 45M over 3 to 5 years including:

- A potential 40% reduction in lead time with €10M working capital reduction, increases in volume and subsequent € 4.8M in incremental margin.

- Supply chain and planning improvements worth addition €5M in working capital reduction and €5M in incremental margin benefits.

Contact us to schedule a complimentary online free consultation and discuss tailored solutions for your business.

Pacellico Blog

Maximizing Supply Chain Efficiency: 3 Tasks to Outsource and 3 to Keep In-House

AUTHOR Lee Eden Lee has extensive experience in global supply chain, logistics and customer [...]

Embracing Sustainability: A Blueprint for Manufacturing Companies

Sustainability has become a critical focus for businesses worldwide, and the manufacturing sector is no exception. [...]

Navigating Uncertainty: Strategies for Building Resilience in Your Business Operations

No matter which business we are working in, uncertainty is the new normal. While lack [...]